This is in continuation of series on biases. Here’s the link for you to quickly go through previous post.

Before we discuss another set of biases again what does being biased mean?

Marketing companies use this trick almost always to sign up superstars to increase sales of their clients. We get lured into buying irrespective of whether we need the product or not.

It is no different in the stock markets. Retail investors often buy because a well-known successful investor bought a stock without knowing about the business prospects or having conviction about the company.

The often quoted sentence is “Mr. X (a successful investor who made millions from investing in stocks) has bought it so he might obviously have thought something and bought it let me also buy it”

· Bias from Envy or Jealousy: Two of the most dangerous emotions human being has envy and jealousy. More money has been lost in trying to earn more than your neighbor by getting into quick rich schemes which is plain stupidity.

How can someone earn more than me by investing in stocks? I don’t know about getting rich but this thinking is a sure shot way to destroy your wealth.

In context of life if your decisions are based on jealousy, you’re almost guaranteed to never be happy no matter how much money you make.

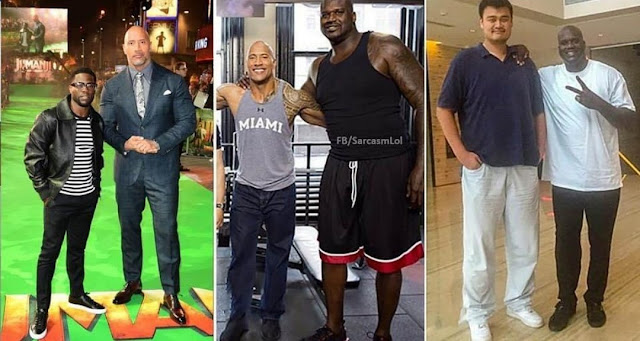

It’s clear from the above image that no matter how great you think you’re, most likely there is someone better than you. If the metric you use to decide how much you want is based on how much someone else has, you’re sowing seeds for destruction and unhappiness.

· Emotional Arousal Bias: Emotions are double-edged sword just like leverage magnifying results at both ends high and low. They would flood your brain with so many thoughts and cloud your judgment.

Overload your brain with imagination led by emotions and reduce its capacity to make good judgments.

Seeing heavy losses in your investment portfolio or having a bad day in life also makes us make stupid decisions with our money.

Beige shopping, eating, and spending to make ourselves feel better sure will help for time being but won’t solve the problem.

Being a highly emotional person that I am, errors in decision making when clouded by emotions was a routine. I have been saved by my mom while being emotionally driven to take a decision which in a rational state of mind I wouldn’t.

One thing which has helped me is being aware and accepting that I have let emotions get the best of me in the past. I usually think more before taking important decisions, write things down in a journal, talk to people whom I trust, and then take decisions.

Sure, this lengthens the process but it helps to avoid being driven solely by emotions.

Further Reads:

Seeking

Wisdom from Darwin to Munger

https://investingreel.blogspot.com/2020/07/are-you-biased.html

Comments

Post a Comment